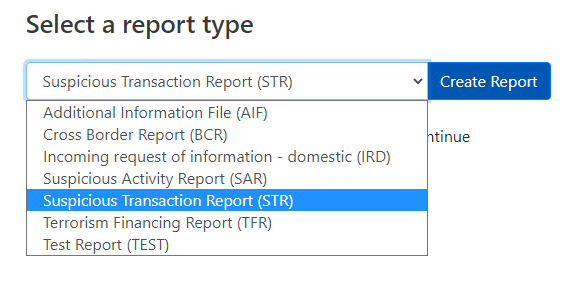

When reporting, you must choose the type of report that suits your grounds for suspicion and the information you have available.

If you do not have information about a transaction, complete a Suspicious Activity Report (SAR). If you want to report a transaction involving an account, it requires a bank account number, and not other types of account number.

The relevant type of report is selected on the basis of information that the reporting party has in its possession.

The Danish FIU observes particular examples of SAR reports, that should have been created as STR reports instead, as those subject to report include transactions in Excel format as attachments. The key difference between a STR report and a SAR report is the basis of suspicion. For a SAR report, the basis for suspicion is behavior and not a transaction, while the basis for a STR report is one or more transactions. To this end, transactions must be understood as all types of transactions.

Suspicious Transaction Report (STR)

This type of notification is used when you suspect that a transaction is involved in money laundering and you have the corresponding bank account information. When reporting this type of report, you must fill in the sender and receiver in the transaction, where at least 1 of the parties must be marked as (My Client).

Suspicious Activity Report (SAR)

This type of report is used when you suspect that an activity is involved in money laundering, or suspect a transaction but with missing bank account information. When reporting this type of report, you must not include or attach transaction information.

Terrorism Financing Report (TFR)

This type of report is used when you suspect that a transaction is involved in terrorist financing and you have the corresponding bank account information. When reporting this type of report, you must fill in the sender and receiver in the transaction, where at least 1 of the parties must be marked as (My Client).

Additional Information File (AIF)

This type of report is used when you have reported suspicious transactions and will add additional transactions to your original report. When reporting this type of report, the supplementary transactions are linked together with the transactions from the original notification. In this report, you must provide a Reference ID from the original report you reported.